- March 17, 2022

- Posted by: Rogers Property Group

- Categories: Latest News, Melbourne Property Market

With Melbourne showcasing one of the least restricted rental markets when it comes to capital cities, the market is showing clear signs of cooling buyer demand, with a noticeable decline in the average number of days rentals are spending online. Sign that the state of the market – as buyer demand slows, this uptick in the search for rentals highlights the changing Melbourne property landscape.

Last year, Melbourne’s land prices grew 11.8% however it cannot be sustained. Melbourne is in the middle of the most dramatic slowdown in the country with records showing no house price growth in February this year as mortgage rates start to rise. According to George Bougias, National Head of Research at Oliver Hume, “the residential market is close to or at its peak and the land market will follow suit as he bills 2022 a “year of consolidation”.

“The frenetic pace of last year and its stimulus and lower interest rates is behind us now, we are cautiously optimistic about the year ahead and we are nearing or at the peak of the residential market. The pace of price growth has lost its steam and the land market may follow. We are at the end of the cycle … we are returning to the normal market” he added.

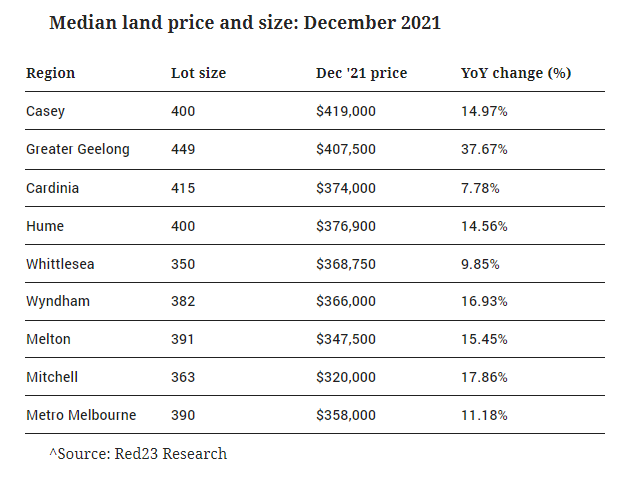

Red23 data on median land price and size as at December 2021 shows land sales volumes across Greater Melbourne and Geelong dropped 24% in the December quarter, compared to the previous quarter. Volumes were down 49% compared to the start of the year when sales were at the highest level.