- September 28, 2021

- Posted by: Rogers Property Group

- Categories: Australian Property Market, Latest News, Queensland Property News

No doubt, high yields and low rental vacancy rates are making these investors more attracted to south-east Queensland property market. As a result of Covid-19, interstate migration has remarkably increased particularly those people seeking for lifestyle properties across Brisbane, the Sunshine Coast, and the Gold Coast.

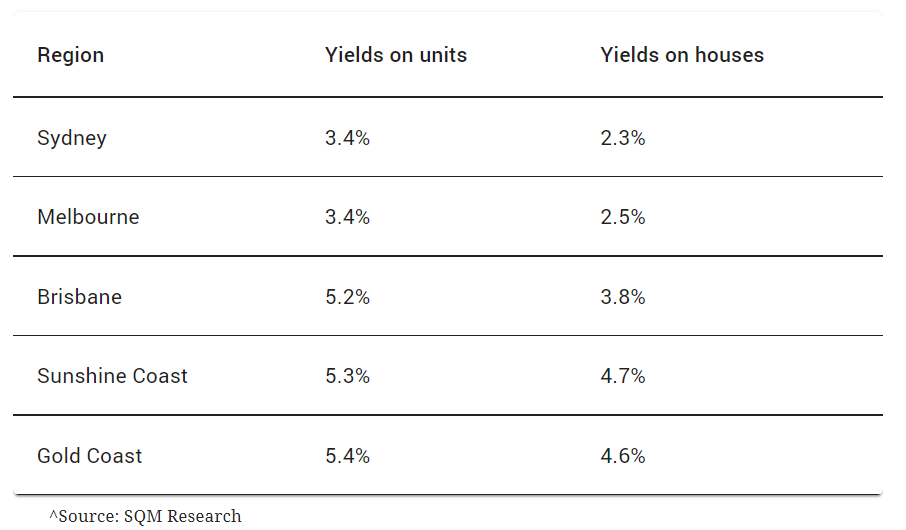

Not only people are getting attracted to live in the Sunshine State, but also more investors are moving into the property market. The Sunshine Coast and Gold Coast top the list of regions with high-rental yield according to SQM data. Houses in both regions are about 4.7% while apartments are 5.3% and 5.4% yields respectively. This is relatively higher than Brisbane, where houses are at 3.8% yield and apartments are sitting at 5.2% yield. Looking at Sydney yields where units are at 3.4% and houses at 2.3%. Whereas Melbourne units and houses are sitting on the bottom at 3.4% and 2.5% respectively. Comparing those yields together gives a clear vision as to why more investors are looking at entering the SEQ market.

According to Ray White chief economist Nerida Consibee, price growth on the Sunshine Coast and Gold Coast has overtaken Brisbane’s median. Prices on the Sunshine Coast had gone up an average of $211,790 over the course of the pandemic, while Gold Coast properties had moved up an extra $181,902. The soaring high levels of migration from Victoria and New South Wales have been the main factor of the price increase in south-east Queensland and the demand for holiday homes has also played a big role. In fact, the number of rental listings across the south-east corner is low, and an average of 70 per cent of the listings have been on the market for less than 30 days.

The table below demonstrates the Rental Yield of each region as at August 2021.