- February 14, 2024

- Posted by: Rogers Property Group

- Categories: Australian Property Market, Latest News, Property Advice, Property Investment

As you are no doubt aware, interest rate did not go up this month when the RBA met on Tuesday 6th of February 2024. The reason there was no increase in rates was due to the reduction in inflation.

Let’s have a closer look at current inflation rates and what is affecting that.

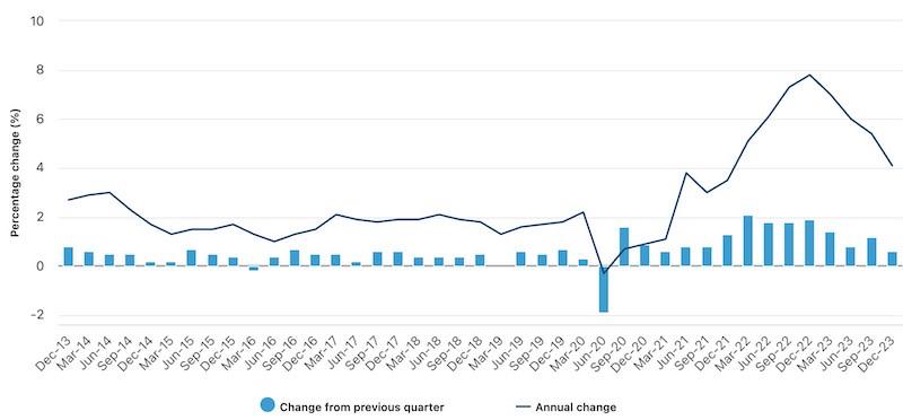

This month inflation dropped by almost 50% since this time a year ago. That is the fastest drop in a long time. The annualised inflationary figure sits at 4.1%. While that drop is both significant and welcome, it is not at the level that the RBA wants and does not yet warrant a rate cut.

When the annualised inflationary figure can get between 2% and 3%, we can expect a cut at that stage. While prices are still rising in Australia, CPI only went up by 0.6% bringing the annualised number down.

Although inflation is coming down, housing is on the increase and was one of the biggest drivers to the increase in CPI. Rental prices also rose through that period making it even harder for those in the rental pool to afford housing.

Tobacco is also on the increase with increases of 6.8% on the monthly CPI indicator.

What we can take away from this is to start investing and stop smoking!

If inflation does continue to decrease as most analysts are predicting, there should be a rate cut in the second half of 2024.